All Categories

Featured

Table of Contents

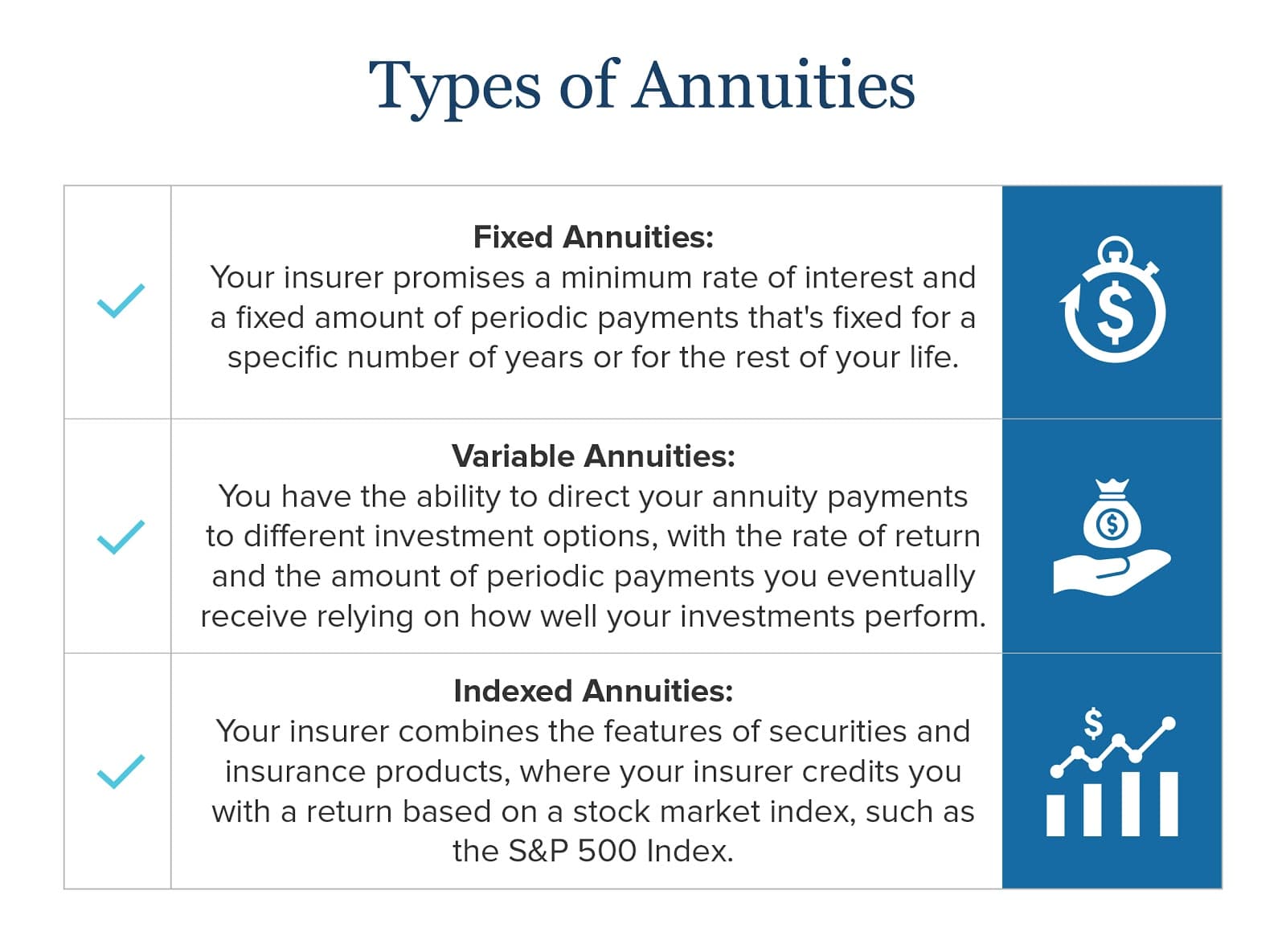

There are three kinds of annuities: taken care of, variable and indexed. With a repaired annuity, the insurer assures both the price of return (the rates of interest) and the payment to the capitalist. The interest price on a taken care of annuity can change with time. Frequently the interest rate is fixed for a variety of years and after that changes regularly based upon existing prices.

With a deferred set annuity, the insurance provider agrees to pay you no less than a specified price of rate of interest as your account is expanding. With an immediate fixed annuityor when you "annuitize" your delayed annuityyou get an established set amount of money, typically on a monthly basis (similar to a pension).

While a variable annuity has the benefit of tax-deferred development, its yearly expenditures are most likely to be a lot greater than the expenses of a typical mutual fund. And, unlike a dealt with annuity, variable annuities do not offer any kind of guarantee that you'll earn a return on your financial investment. Rather, there's a threat that you might really shed money.

Highlighting Fixed Income Annuity Vs Variable Growth Annuity Everything You Need to Know About Financial Strategies Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Fixed Vs Variable Annuity Is Worth Considering How to Compare Different Investment Plans: Simplified Key Differences Between Different Financial Strategies Understanding the Rewards of Long-Term Investments Who Should Consider Fixed Income Annuity Vs Variable Growth Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at What Is A Variable Annuity Vs A Fixed Annuity

Due to the complexity of variable annuities, they're a leading source of capitalist issues to FINRA. Before purchasing a variable annuity, very carefully checked out the annuity's syllabus, and ask the person offering the annuity to clarify all of the product's features, motorcyclists, prices and limitations. Indexed annuities generally offer a minimum guaranteed passion price integrated with an interest rate linked to a market index.

Comprehending the features of an indexed annuity can be complicated. There are numerous indexing techniques firms make use of to calculate gains and, due to the selection and complexity of the approaches utilized to credit scores passion, it's hard to contrast one indexed annuity to an additional. Indexed annuities are usually categorized as one of the adhering to two types: EIAs use a guaranteed minimum rate of interest (typically a minimum of 87.5 percent of the costs paid at 1 to 3 percent interest), in addition to an extra interest price tied to the efficiency of several market index.

Conservative capitalists that value security and security. Those nearing retirement that want to shelter their assets from the volatility of the stock or bond market. With variable annuities, you can buy a variety of securities consisting of stock and mutual fund. Stock exchange performance figures out the annuity's worth and the return you will certainly obtain from the cash you invest.

Comfortable with variations in the stock market and want your financial investments to equal rising cost of living over an extended period of time. Youthful and intend to prepare monetarily for retirement by gaining the gains in the stock or bond market over the lengthy term.

As you're accumulating your retired life financial savings, there are several means to stretch your money. can be especially valuable financial savings devices since they guarantee an income amount for either a collection amount of time or for the remainder of your life. Dealt with and variable annuities are 2 options that provide tax-deferred development on your contributionsthough they do it in different methods.

Highlighting the Key Features of Long-Term Investments Everything You Need to Know About Fixed Index Annuity Vs Variable Annuities Defining Fixed Annuity Vs Variable Annuity Features of Smart Investment Choices Why Fixed Index Annuity Vs Variable Annuities Can Impact Your Future Fixed Income Annuity Vs Variable Annuity: Simplified Key Differences Between Deferred Annuity Vs Variable Annuity Understanding the Rewards of Long-Term Investments Who Should Consider Fixed Income Annuity Vs Variable Annuity? Tips for Choosing Fixed Vs Variable Annuity Pros Cons FAQs About Fixed Interest Annuity Vs Variable Investment Annuity Common Mistakes to Avoid When Choosing What Is Variable Annuity Vs Fixed Annuity Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Variable Vs Fixed Annuity

variable annuity or both as you outline out your retired life earnings strategy. An offers a guaranteed rate of interest. It's taken into consideration a conventional product, providing a modest earnings that are not linked to market efficiency. Your contract value will boost because of the amassing of ensured passion revenues, implying it won't shed value if the market experiences losses.

Your variable annuity's financial investment performance will certainly influence the size of your nest egg. When you begin taking annuity settlements, they will certainly depend on the annuity value at that time.

Market losses likely will result in smaller payments. Any type of interest or various other gains in either kind of contract are protected from current-year tax; your tax responsibility will certainly come when withdrawals start. Let's check out the core attributes of these annuities so you can decide how one or both may fit with your overall retirement strategy.

A set annuity's worth will certainly not decline because of market lossesit's regular and steady. On the various other hand, variable annuity values will vary with the efficiency of the subaccounts you elect as the marketplaces increase and drop. Earnings on your taken care of annuity will highly depend upon its acquired price when acquired.

On the other hand, payout on a repaired annuity acquired when rates of interest are reduced are more probable to pay profits at a reduced price. If the rate of interest is ensured for the length of the contract, profits will certainly stay continuous no matter of the marketplaces or price activity. A fixed rate does not mean that repaired annuities are safe.

While you can not arrive on a fixed price with a variable annuity, you can select to buy traditional or aggressive funds tailored to your danger degree. Much more conventional financial investment choices, such as temporary mutual fund, can aid reduce volatility in your account. Since dealt with annuities use an established price, reliant upon present rate of interest, they do not supply that same versatility.

Decoding How Investment Plans Work A Closer Look at How Retirement Planning Works What Is What Is Variable Annuity Vs Fixed Annuity? Features of Fixed Interest Annuity Vs Variable Investment Annuity Why Choosing the Right Financial Strategy Is a Smart Choice How to Compare Different Investment Plans: How It Works Key Differences Between Fixed Vs Variable Annuity Understanding the Rewards of Variable Vs Fixed Annuities Who Should Consider Retirement Income Fixed Vs Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Tax Benefits Of Fixed Vs Variable Annuities Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Income Annuity Vs Variable Growth Annuity A Beginner’s Guide to What Is Variable Annuity Vs Fixed Annuity A Closer Look at How to Build a Retirement Plan

You potentially might gain much more long term by taking extra danger with a variable annuity, however you can also shed money. While dealt with annuity contracts avoid market danger, their trade-off is much less growth potential.

Spending your variable annuity in equity funds will certainly provide even more possible for gains. The fees connected with variable annuities may be greater than for various other annuities.

The insurance coverage firm might impose abandonment charges, and the Internal revenue service might levy a very early withdrawal tax penalty. They start at a certain percent and after that decrease over time.

Annuity earnings undergo a 10% very early withdrawal tax obligation charge if taken before you reach age 59 unless an exception applies. This is enforced by the internal revenue service and uses to all annuities. Both repaired and variable annuities supply choices for annuitizing your equilibrium and transforming it into an ensured stream of life time income.

Analyzing Strategic Retirement Planning A Comprehensive Guide to Investment Choices What Is Pros And Cons Of Fixed Annuity And Variable Annuity? Benefits of Fixed Interest Annuity Vs Variable Investment Annuity Why Choosing the Right Financial Strategy Is Worth Considering Fixed Annuity Vs Equity-linked Variable Annuity: Simplified Key Differences Between Annuities Fixed Vs Variable Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Variable Vs Fixed Annuities Financial Planning Simplified: Understanding Fixed Annuity Vs Equity-linked Variable Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at Choosing Between Fixed Annuity And Variable Annuity

You may decide to make use of both repaired and variable annuities. If you're selecting one over the various other, the distinctions issue: A may be a much better alternative than a variable annuity if you have an extra conventional risk resistance and you seek predictable passion and principal defense. A may be a better option if you have a higher danger resistance and want the capacity for lasting market-based growth.

Annuities are agreements offered by insurer that assure the buyer a future payout in regular installments, typically monthly and typically for life. There are various kinds of annuities that are made to serve different purposes. Returns can be dealt with or variable, and payments can be immediate or deferred. A set annuity guarantees settlement of a collection amount for the regard to the arrangement.

A variable annuity changes based upon the returns on the shared funds it is purchased. Its value can go up or down. A prompt annuity starts paying as quickly as the purchaser makes a lump-sum payment to the insurer. A deferred annuity begins repayments on a future day established by the purchaser.

An annuity that offers surefire earnings for life (or beyond, for your beneficiary) likewise ensures you that also if you deplete their other properties, you will still have some earnings coming in. Annuities' returns can be either dealt with or variable. Each type has its pros and cons. With a repaired annuity, the insurer ensures the customer a details repayment at some future date.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning Key Insights on Your Financial Future What Is the Best Retirement Option? Advantages and Disadvantages of Annuities Variable Vs Fixed Why Variable Annuity Vs Fi

Decoding How Investment Plans Work Everything You Need to Know About Fixed Annuity Or Variable Annuity Breaking Down the Basics of Tax Benefits Of Fixed Vs Variable Annuities Advantages and Disadvanta

Understanding Fixed Interest Annuity Vs Variable Investment Annuity Key Insights on Your Financial Future Breaking Down the Basics of Investment Plans Benefits of Fixed Annuity Vs Equity-linked Variab

More

Latest Posts